Facebook IPO Price

The Facebook IPO Price, a pivotal moment in the company's history, marked its transition from a privately held entity to a publicly traded one. This event took place on May 18, 2012, with an initial offering price of $38 per share, valuing the social media giant at over $100 billion. However, the IPO faced challenges as the stock struggled to meet the high expectations of investors. In the subsequent months, Facebook's stock price experienced volatility, with fluctuations that stirred discussions in financial circles. Despite the initial turbulence, Facebook's development post-IPO has been remarkable, with the company adapting and evolving in response to market dynamics. For those seeking insights into this transformative period or exploring the broader context of Facebook's journey, resources like Facebook Development Assignment Help can offer valuable perspectives on the company's growth and strategic decisions.

What Was The Initial Facebook IPO Price?

In the realm of social media giants, Facebook's Initial Public Offering (IPO) was a historic moment that significantly impacted the tech and financial landscapes. Launched on May 18, 2012, Facebook went public with an IPO price of $38 per share. This highly anticipated event marked a pivotal juncture for the company, as it transitioned from a privately held entity to a publicly traded one. Investors and analysts closely watched the IPO, and its performance was scrutinized in the context of the evolving social media and technology markets. For those delving into the complexities of Facebook's trajectory, whether for academic pursuits or professional insights, understanding the nuances of its IPO is crucial. Students and professionals seeking comprehensive insights into Facebook's financial history, market strategies, and subsequent developments can benefit from specialized resources like Facebook Marketing Assignment Help to navigate the intricacies of this dynamic field and gain a deeper understanding of the company's journey.

How Did The Facebook IPO Price Compare To Expectations?

The Facebook Initial Public Offering (IPO) in 2012 was one of the most anticipated events in the financial world. The IPO price, initially set at $38 per share, created a buzz among investors and analysts. However, it soon became evident that the Facebook IPO did not meet the high expectations set by the market. The stock struggled in its early days of trading, facing challenges in maintaining its initial price. This discrepancy between expectations and reality prompted discussions and analyses across financial circles.

Investors seeking insight into the Facebook IPO's performance might turn to various sources, including social media sentiment analysis and financial experts. Assignments related to understanding the dynamics of the Facebook IPO, such as those seeking Facebook API assignment help or assignment assistance, could delve into the market's reactions and the factors influencing the stock's pricing. This event remains a significant case study for financial analysts and students, offering valuable lessons in assessing market expectations and the actual performance of high-profile IPOs.

When Was The Facebook IPO Price Officially Determined?

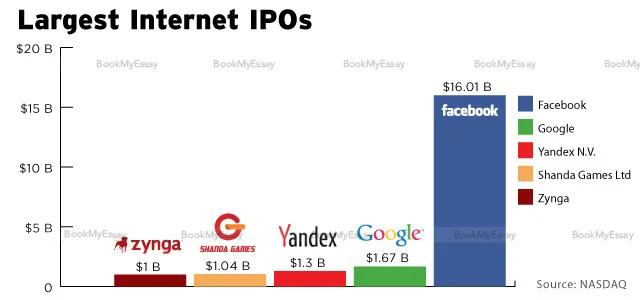

The official determination of Facebook's Initial Public Offering (IPO) price occurred on May 17, 2012. This marked a pivotal moment in the social media giant's history, as it transitioned from a private company to a publicly traded entity. The IPO price was set at $38 per share, valuing the company at over $100 billion and making it one of the largest IPOs in history at the time.

For students seeking insights into this financial milestone, Assignment Provider can offer valuable assistance in understanding the intricacies of Facebook's IPO and its impact on the business landscape. Assignment Paper Help from experts in finance and economics can provide in-depth analysis, exploring the factors influencing the IPO price and the subsequent market dynamics. With a comprehensive understanding of such critical events, students can gain a deeper perspective on financial markets and the strategies employed by companies during significant milestones like IPOs.

Advantages of Using BookMyEssay to Order Assignment Solutions

BookMyEssay offers distinct advantages when ordering assignment solutions, primarily due to its commitment to quality and professionalism. One key advantage lies in the Five Features of Skilled Assignment Writers employed by the platform. These writers possess expertise in diverse subjects, ensuring the delivery of well-researched and comprehensive assignments. Their proficiency guarantees the production of high-quality content that meets academic standards.

Additionally, BookMyEssay prioritizes timely delivery, providing students with ample time for review and submission. The platform's commitment to originality and plagiarism-free content is another notable feature, reinforcing academic integrity. The user-friendly interface enhances the overall experience, making it easy for students to place orders and communicate with writers. Moreover, the customer support team ensures round-the-clock assistance, addressing queries and concerns promptly. By leveraging these advantages, BookMyEssay emerges as a reliable and efficient platform for students seeking top-notch assignment solutions.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029