Effective Interest Rate

The Effective Interest Rate (EIR), also known as the Effective Interest Method, is a crucial financial concept that provides a more accurate representation of the true cost of borrowing or the return on investment over a specific period. Unlike nominal interest rates, which don't account for compounding, the EIR considers compounding intervals, offering a more precise measure of the cost or return.

Calculated by incorporating compounding factors into the nominal interest rate, the EIR reflects the actual interest cost or earnings when compounding occurs multiple times within a given period. This method is particularly essential for financial instruments like loans or bonds, where interest compounds regularly. By understanding the Effective Interest Rate, borrowers and investors can make more informed decisions, as it offers a comprehensive view of the financial implications associated with a particular interest rate, aiding in better financial planning and decision-making.

How Is The Effective Interest Rate Calculated?

The effective interest rate (EIR) is a crucial metric in finance, representing the true cost of borrowing or the actual return on investment. Calculating EIR can be challenging, often requiring assistance, especially for students grappling with math problems. Seeking Math Assignment Help is a wise approach to master the intricacies of EIR calculations.

To compute EIR, consider factors like nominal interest rates, compounding periods, and fees. The formula involves adjusting nominal rates for compounding frequency, providing a more accurate reflection of the interest accrued. Math Assignment Help services can guide students through this complex process, ensuring a solid understanding of the underlying mathematical concepts. Tutors can clarify doubts, offer step-by-step explanations, and empower students to tackle EIR problems with confidence. Ultimately, grasping EIR calculations not only enhances academic performance but also cultivates valuable analytical skills essential for real-world financial scenarios. Seeking help with math problems is an investment in academic success and a foundation for future financial proficiency.

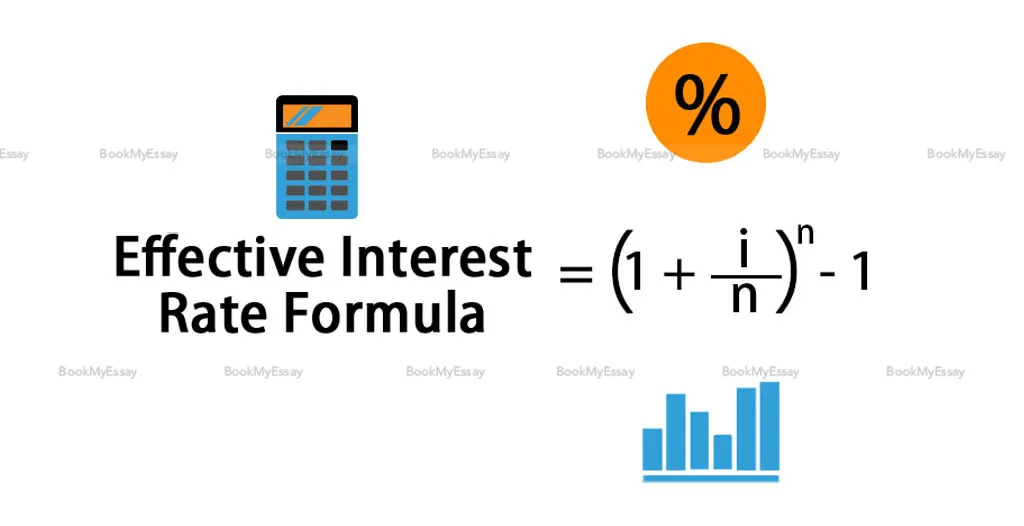

What Is The Formula for Effective Interest Rates?

In the realm of finance, understanding the formula for effective interest rates is paramount, especially for students grappling with math coursework. This crucial concept forms the backbone of financial calculations, making it a focal point in assignments and coursework. Effective interest rates encapsulate not just nominal interest rates but also account for compounding periods, providing a more accurate representation of the true cost of borrowing or the actual return on an investment.

For those seeking assignment help online in their math coursework, grasping the intricacies of effective interest rate formulas can be a game-changer. Tutors and platforms offering online assistance delve into the nuances of these calculations, ensuring students comprehend the impact of compounding frequency on overall interest. Mastering this formula empowers learners to navigate financial landscapes with acumen, fostering a foundation for making informed decisions in the complex world of finance. In the dynamic educational landscape, online resources serve as invaluable tools for students striving to excel in math-intensive subjects like finance.

What Makes the Effective Annual Interest Rate Unused by Banks?

In the realm of academic writing, the Effective Annual Interest Rate (EAR) stands as a crucial concept, yet its underutilization by banks raises intriguing questions. Despite its significance in assessing the true cost of borrowing, banks often neglect to employ the EAR in their financial dealings. This oversight may stem from a variety of factors, such as the complexity of the calculations involved and a preference for simpler interest rate metrics. Assignment writing services frequently explore this paradox, delving into the intricacies of financial literature to unravel the reasons behind the limited adoption of EAR by banks.

Scholars engaged in academic writing often ponder whether this reluctance is a result of systemic inertia, where traditional practices overshadow more comprehensive metrics. Additionally, the industry's reliance on simpler interest rate models for communication and marketing purposes may contribute to the underemphasis on EAR. As assignment writing services delve into the nuances of financial theories, they illuminate the intricate dynamics that surround the effective annual interest rate's underutilization in the banking sector.

Advantages of Using BookMyEssay to Order Assignment Solutions

Select a Reliable Assignment Writing Service is crucial for academic success, and BookMyEssay stands out as a top choice for students seeking impeccable assignment solutions. One of the key advantages is the platform's commitment to quality, ensuring that each assignment is crafted with precision and adheres to academic standards. The team of experienced writers at BookMyEssay is adept at handling diverse subjects, providing comprehensive and well-researched content.

Timely delivery is another significant benefit, as assignments are completed within stipulated deadlines, allowing students to submit their work on time. Moreover, the platform offers a seamless and user-friendly ordering process, making it convenient for students to place their assignments without hassle. BookMyEssay's customer support is responsive and efficient, addressing queries promptly. Additionally, the service ensures confidentiality and plagiarism-free content, instilling confidence in students relying on external assistance. Choosing BookMyEssay proves to be advantageous for students seeking excellence in their academic endeavors.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029