Effective Interest Method

The Effective Interest Method is a financial accounting approach used to calculate the true cost of borrowing or the actual yield on financial instruments like loans, bonds, or mortgages. It factors in all associated costs, fees, and expenses over the entire life of the loan to determine the effective interest rate (EIR). Unlike the nominal interest rate, which doesn't account for additional charges, the effective interest rate provides a more accurate representation of the borrowing cost.

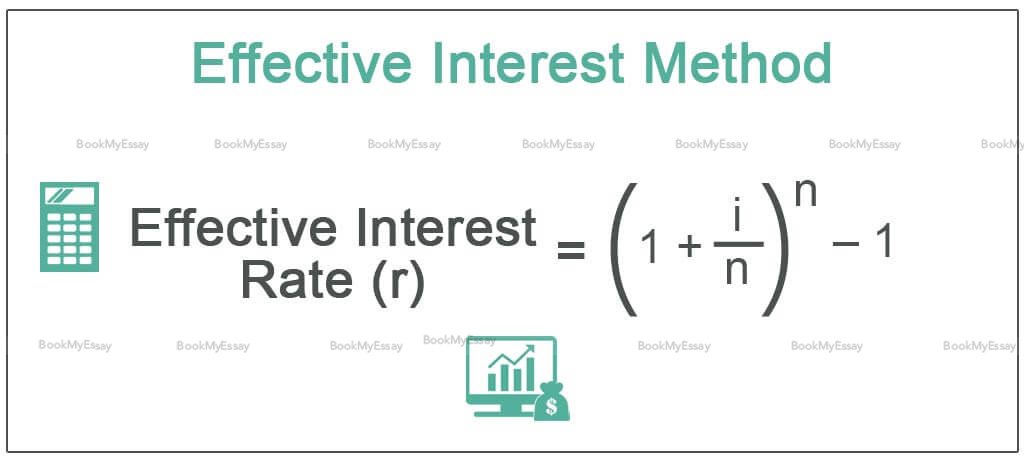

To calculate Effective Interest Rate, the method considers the nominal rate, compounding periods, and any associated fees or costs. It amalgamates these elements into a single rate that reflects the true expense incurred by the borrower or earned by the lender. This method is particularly useful for amortizing loans or debt instruments, as it allocates interest and associated costs across each period based on the outstanding balance.

By employing the Effective Interest Method, financial entities can make more informed decisions, accurately assessing the actual cost of borrowing or the real return on investments. It aids in precise financial reporting, ensuring compliance with accounting standards and providing stakeholders with a comprehensive understanding of the true financial implications of a transaction.

Describe Interest Method

Understanding interest rates, money, and central banking is pivotal in today's financial landscape. When delving into these concepts, seeking "Interest Rates, Money, and Central Banking Assignment Help" becomes crucial for grasping the nuances. Engaging an "Online Assignment Writing Help Service for University" proves invaluable in navigating complex theories.

Interest methods form the bedrock of financial calculations, determining how interest accrues over time. The Effective Interest Method stands out in finance, facilitating the calculation of the actual interest expense or income by considering the effect of compounding. It's a dynamic approach often utilized in bond accounting, loan amortization, and calculating annual percentage rates.

Through the Effective Interest Method, the interest rate adjusts according to changes in principal amounts or payment frequencies, offering a more precise reflection of financial realities. It's a vital tool in understanding the real cost of borrowing or investing, crucial for financial analysts, accountants, and economists alike.

Online assignment writing services specializing in finance and economics can provide comprehensive guidance on the Effective Interest Method. These platforms offer insightful explanations, examples, and practical applications, empowering students to grasp the intricacies of interest calculations and their impact on financial decisions.

What Is the Effective Interest Method?

The Effective Interest Method is a vital concept within finance, pivotal in calculating interest on loans or investments. It’s a dynamic approach that considers compound interest, reflecting the true cost or value of borrowed or invested funds over time. In essence, it recalculates interest on the outstanding balance, adjusting as the principal changes due to repayments or additional funds.

For Finance Assignment Help or Assignment Help Online, understanding this method is crucial. It involves computing the true interest rate by factoring in compounding periods and adjusting for any fees or costs spread over the loan or investment's life.

This method is widely employed in amortizing bonds, determining the actual yield of a financial instrument, or assessing the interest expense on long-term liabilities. It provides a more accurate representation of interest accrual than simple interest calculations.

For university students seeking clarity on these concepts, Assignment Help Online caters to comprehensively explaining the Effective Interest Method. Mastering this technique aids in making informed financial decisions and analyzing the real cost or earnings potential of investments or loans over time.

How Is The Effective Interest Approach Calculated by BookMyEssay?

BookMyEssay employs a meticulous methodology to calculate the Effective Interest Approach, a critical aspect of finance. To unravel this, six crucial elements govern the process when creating an economics essay focused on bank marketing. Professional Essay Writers at BookMyEssay utilize these elements proficiently.

Firstly, the experts commence by comprehensively grasping the essay's objectives and directives and aligning their approach accordingly. Then, they meticulously research and analyze relevant data concerning bank marketing and its economic implications. These writers adeptly interpret complex financial concepts associated with the Effective Interest Approach, ensuring precision in their exposition.

Next, they structure the essay meticulously, maintaining a coherent flow of ideas and leveraging a logical framework. Crucially, these professionals emphasize real-world examples and case studies, substantiating the theoretical content with practical instances.

Furthermore, the essay's content undergoes rigorous scrutiny for accuracy and relevance. Professional Essay Writers at BookMyEssay ensure that the analysis of bank marketing within the Effective Interest Approach is comprehensive and insightful.

Lastly, they meticulously proofread and edit the essay, guaranteeing flawless language and adherence to academic standards. This comprehensive approach ensures a top-notch economics essay on bank marketing employing the Effective Interest Approach, reinforcing BookMyEssay prowess in delivering exceptional Assignment Help Online.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029