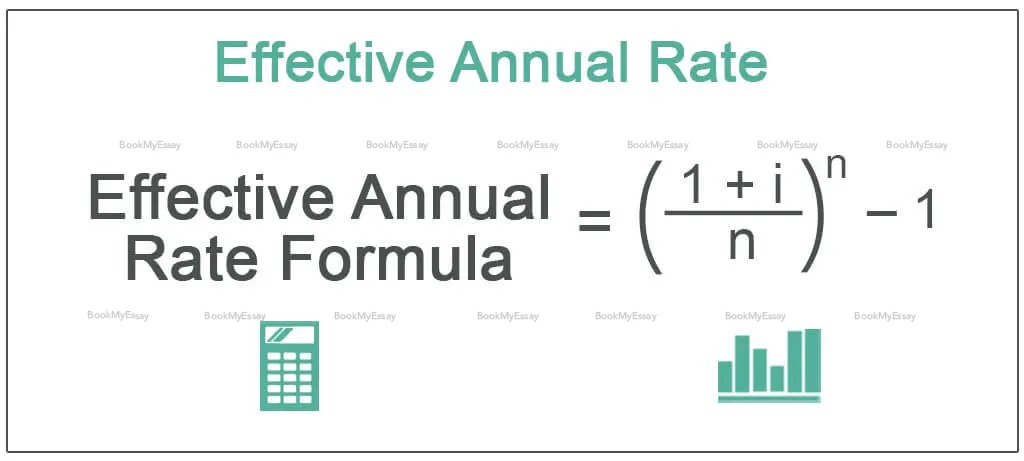

Effective Annual Rate Formula

The Effective Annual Rate (EAR) formula is pivotal in determining the actual annual interest rate on a financial instrument, accounting for compounding effects within a year. To calculate the Effective Annual Rate, use the formula: EAR=(1+nr​)n−1, where 'r' represents the nominal interest rate, and 'n' signifies the number of compounding periods within one year.

This formula unveils the true cost of borrowing or the actual return on investment, enabling precise comparisons between different offers with varying compounding frequencies. Understanding the EAR aids in making informed financial decisions by harmonizing the impact of compounding on loans, investments, or savings. By employing this formula, individuals and businesses can grasp the real annualized rate, ensuring transparency and accuracy in financial planning and decision-making processes.

How Is The Effective Annual Rate (Ear) Calculated?

The Effective Annual Rate (EAR) quantifies the actual annual interest rate considering compounding effects. To compute EAR accurately for investments or loans with various compounding periods, use this formula: EAR = (1 + (nominal rate / n))^n - 1. Here, the nominal rate represents the stated annual interest rate, and 'n' signifies the number of compounding periods within a year. For instance, if a nominal rate of 8% compounds quarterly, the EAR equals (1 + (0.08 / 4))^4 - 1. Seeking "Math Assignment Help" or "Math Answerer Assignment Help" is beneficial in grasping such concepts effectively. Professional guidance aids in understanding the intricate calculations involved in determining the true annual rate, crucial for accurate financial assessments and investment decisions.

What Elements Are Taken Into Account When Calculating The Effective Annual Rate?

Calculating the Effective Annual Rate (EAR) involves various elements pivotal in determining true interest costs. This computation considers compounding frequency and nominal interest rate adjustments. The formula incorporates both to present a precise representation of an annualized interest rate. When solving "math word problems calculator Assignment Help," students must comprehend the compounding periods within a year, adjusting rates accordingly. Factors like annual report design could impact interest calculations, with varying compounding periods affecting financial presentations. Key components for EAR include nominal interest rates, compounding intervals, and periods. Understanding these elements aids in precise interest assessments for loans, investments, or financial analysis. Mastering EAR calculation not only assists in academic assignments but also enables informed financial decisions and accurate annualized rate interpretations within business contexts.

Could You Explain How The Effective Annual Rate Is Calculated?

For students seeking assignment help or a homework helper to comprehend the Effective Annual Rate (EAR), understanding its calculation is pivotal. The EAR represents the actual yearly interest rate when compounding occurs more than once a year, offering a precise measure for comparing different loan or investment options.

To calculate the EAR, the nominal interest rate and the number of compounding periods within a year are crucial. First, convert the nominal rate to a periodic rate, then add 1 to the periodic rate, and raise it to the power of the number of compounding periods. Subtract 1 from the result and multiply it by the number of compounding periods to obtain the EAR formula. This process enables students to gauge the real impact of compounding frequency on the overall interest accrued annually, proving essential in financial decision-making and analysis.

Why Does Financial Analysis Need To Consider The Effective Annual Rate?

Financial analysis must consider the Effective Annual Rate (EAR) due to its ability to accurately reflect the true cost of borrowing or the actual return on investment over a year. When examining metrics like the Compounded Annual Growth Rate (CAGR) of Walmart in India, understanding the EAR becomes crucial. The CAGR, highlighting Walmart's growth, may seem impressive, but without factoring in the EAR, the actual impact of compounding frequencies on returns or costs might be overlooked. Ignoring EAR could mislead investors or analysts regarding the real profitability or expenses involved in sustaining such growth. By incorporating EAR in financial analysis, especially concerning CAGR for companies like Walmart in India, a more precise assessment of investment performance or borrowing costs emerges, ensuring better-informed decision-making and a clearer understanding of the actual financial implications over time.

Is It Possible To Determine The Effective Annual Rate Accurately With BookMyEssay's Help?

BookMyEssay provides adept assistance in computing the Effective Annual Rate (EAR) accurately, catering to "write my assignment for me" queries. Their proficient financial experts ensure precise calculations based on various compounding periods, elucidating complex concepts with clarity. Utilizing pertinent formulas and methodologies, they decipher nominal rates into their corresponding annualized values, fostering a comprehensive understanding of assignments. BookMyEssay’s commitment to accuracy ensures reliable computations, empowering students to grasp the intricacies of interest rate conversions. Leveraging their expertise ensures a meticulous analysis of EAR, factoring in compounding frequencies for precise assessments. Entrusting this task to BookMyEssay guarantees not just accurate results but also a comprehensive comprehension of how to calculate and interpret Effective Annual Rates, enriching academic knowledge and assignment excellence.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029