Calculate The Effective Annual Rate

Math Assignment Help: Understanding and calculating the Effective Annual Rate (EAR) is crucial in financial mathematics. The EAR represents the true annual interest rate, considering compounding over a specified period. To calculate EAR, the nominal interest rate and the number of compounding periods per year are essential. The formula involves adjusting for compounding effects, providing a more accurate representation of the cost of borrowing or the return on investment. Math assignments often involve applying this concept to analyze financial scenarios, making it imperative for students to grasp the intricacies of EAR calculations. Seeking math assignment help allows students to navigate these complexities, ensuring a comprehensive understanding of financial mathematics and enhancing problem-solving skills in real-world financial contexts.

How Do You Calculate The Effective Annual Rate (Ear)?

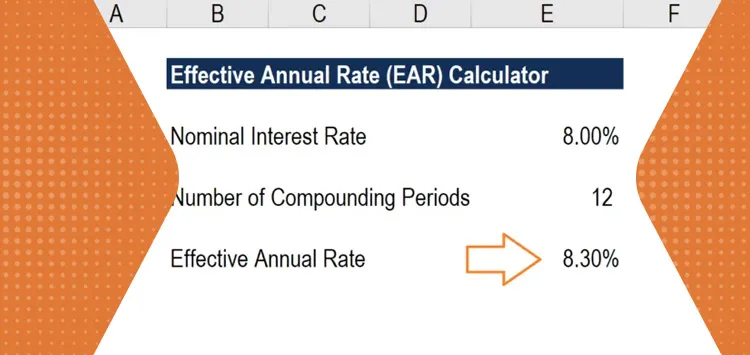

Calculating the Effective Annual Rate (EAR) is crucial for accurate financial assessments, especially in the realm of annual report design. To compute EAR, one must consider compounding effects on interest rates, a vital aspect when presenting financial data in annual reports. The formula involves factoring in both nominal interest rates and the frequency of compounding within a year. By incorporating these elements, annual report designers ensure that financial information accurately reflects the true cost of borrowing or investment over time. Precise EAR calculations contribute to the transparency and credibility of financial reports, providing stakeholders with a comprehensive understanding of the organization's financial performance. As an integral component of annual report design, attention to the Effective Annual Rate enhances the clarity and reliability of communicated financial information.

What Factors Are Considered In Determining The Effective Annual Rate?

In the realm of finance, determining the Effective Annual Rate (EAR) is crucial, especially when seeking assignment help in understanding the intricacies of interest rates. Several factors come into play when calculating the EAR to ensure accuracy and precision. Firstly, the nominal interest rate, representing the stated rate on the financial product, is considered. Additionally, the frequency of compounding, such as annually, semi-annually, or quarterly, profoundly impacts the EAR. Assignment help often emphasizes the significance of compounding periods in obtaining a true reflection of the annual rate. Moreover, fees and transaction costs associated with the financial arrangement are integral to the calculation. By comprehensively examining these factors, students seeking assignment help can grasp the nuances of determining the Effective Annual Rate, facilitating a deeper understanding of financial concepts.

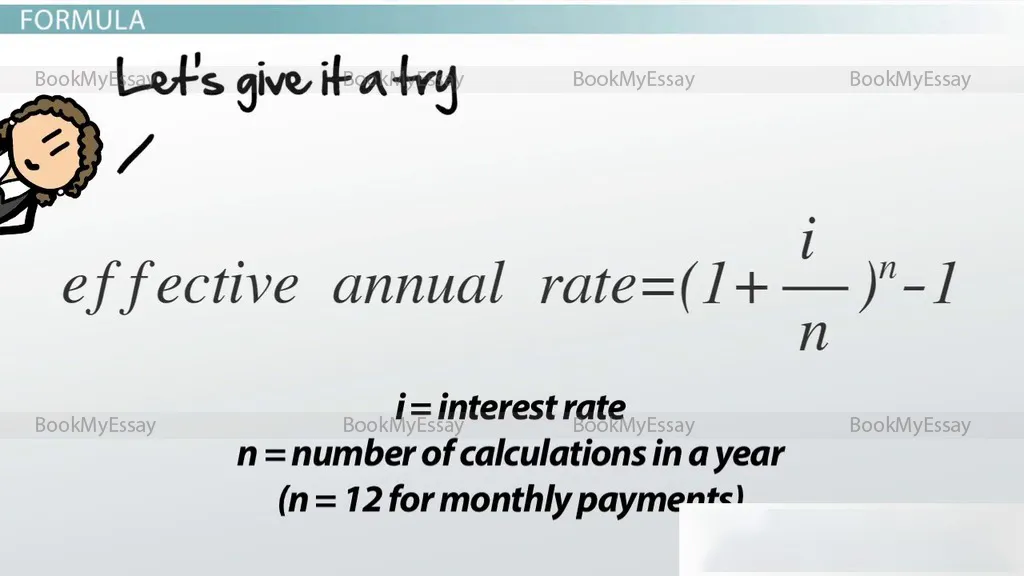

Can You Explain The Formula For Calculating The Effective Annual Rate?

The Effective Annual Rate (EAR) is a crucial metric in finance, representing the true annual interest rate when compounding occurs more frequently than annually. While unrelated to the Compounded Annual Growth Rate of Walmart in India, the EAR is computed using the formula: (1+nr​)n−1, where r is the nominal interest rate and n is the number of compounding periods per year. Now, shifting to Walmart's CAGR in India, it gauges the average annual growth rate over a specified time. Analyzing Walmart's CAGR in the Indian market provides insights into its sustainable expansion and market performance, distinct from the EAR formula used in financial contexts.

Why Is The Effective Annual Rate Important In Financial Analysis?

The Effective Annual Rate (EAR) is crucial in financial analysis as it provides a comprehensive measure of the true cost of borrowing or the actual return on investment. When tasked with assignments like "write my assignment for me," understanding EAR becomes imperative. Unlike nominal interest rates, EAR considers compounding, reflecting the impact of interest on interest. This is vital for accurate financial decision-making, especially in comparing different financial products or investment opportunities. It enables individuals and businesses to assess the real cost of loans or the actual yield on investments over a specific period, facilitating informed choices. Mastery of EAR is a valuable skill, ensuring that assignments on financial analysis are not only well-informed but also reflect a nuanced understanding of the intricacies of interest rate calculations.

Can BookMyEssay Assist In Determining The Effective Annual Rate Accurately?

BookMyEssay plays a crucial role in helping individuals accurately determine the Effective Annual Rate (EAR). With a team of skilled financial experts, the platform offers specialized assistance in navigating complex financial calculations associated with EAR. The service ensures precision by considering various factors such as compounding periods, nominal interest rates, and associated fees. BookMyEssay commitment to accuracy extends to providing step-by-step guidance, elucidating the intricacies of EAR calculations. Users can leverage the platform's expertise to enhance their financial literacy and make informed decisions. Whether for academic assignments or practical financial planning, BookMyEssay stands out as a reliable resource for those seeking precise and efficient solutions in determining the Effective Annual Rate.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029