What Do Deferred Payment Mean

Deferred payment refers to a financial arrangement where the payment for goods or services is delayed to a later date, allowing the buyer to enjoy immediate possession or use without an immediate cash outlay. In this context, "What Do Deferred Payment Mean" implies understanding the postponement of payment obligations. This arrangement is often beneficial for both buyers and sellers, offering flexibility in managing cash flow. The Deferred Payment Meaning involves an agreement between parties outlining the terms and conditions of the delay, including the agreed-upon date for payment. It is common in various industries, such as real estate, where buyers might opt for deferred payments to facilitate easier budgeting. However, it's crucial for all parties involved to clearly define the terms to avoid misunderstandings or disputes. The concept of deferred payment is a financial strategy that can provide advantages in specific situations, balancing the needs of both buyers and sellers in the transaction.

Can You Explain The Concept Of Deferred Payment In Simple Terms?

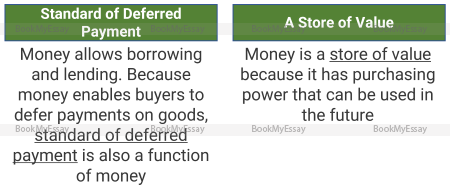

Deferred payment is a financial concept that involves postponing the settlement of a debt or financial obligation to a later date. In simple terms, it refers to an arrangement where a buyer can purchase goods or services and make payment at a future agreed-upon date rather than immediately. This delay in payment is governed by a set of terms known as the "Standard of Deferred Payments."

In essence, a deferred payment allows individuals or businesses to acquire needed items without having to make an immediate cash outlay. It provides flexibility and convenience in managing finances, allowing the buyer to use the purchased goods or services before making the payment. This concept is common in various transactions, such as installment plans for large purchases or trade agreements between parties.

Understanding the standard of deferred payments is crucial in navigating financial arrangements and contractual agreements, ensuring that both parties involved have clear expectations regarding the timing and conditions of payment.

What Are The Advantages And Disadvantages Of Deferred Payment?

Deferred payment, a financial arrangement where the payment is postponed to a later date, offers both advantages and disadvantages. One of the primary benefits is that it provides individuals and businesses with increased flexibility in managing their cash flow. This can be particularly advantageous when facing temporary financial constraints. Moreover, deferred payment allows for the potential to invest or generate returns with the money that would have been spent upfront.

On the flip side, delayed payments come with certain drawbacks. Interest charges or additional fees may accrue during the deferral period, increasing the overall cost of the transaction. This can pose a financial burden, especially if the terms are not thoroughly understood. Additionally, reliance on deferred payments can lead to overspending and accumulation of debt if not managed prudently.

For students seeking academic assistance, the availability of online assignment help is a valuable advantage. However, it's crucial to be mindful of potential downsides, such as plagiarism concerns or dependence on external sources impacting the learning process. Balancing the advantages and disadvantages of deferred payment, whether in financial transactions or academic support, requires careful consideration of individual circumstances and prudent decision-making.

How Does Deferred Payment Differ From Immediate Payment?

Deferring payments, often referred to as deferred payment, stands in stark contrast to immediate payment, showcasing a fundamental difference in financial transactions. Deferring payments involves postponing the settlement of financial obligations to a later date, providing flexibility and easing immediate monetary burdens. This practice allows individuals or businesses to manage cash flow more effectively, aligning payments with anticipated future income.

On the other hand, immediate payment demands instant settlement of financial commitments, ensuring prompt and on-the-spot transactions. The distinction between these two approaches is vital, impacting financial planning and resource allocation. In the realm of academic services, the deferring payments meaning finds relevance in the context of assignment writing services. Some providers may offer deferred payment options to students, enabling them to access assistance without immediate financial strain. Understanding the nuances of deferred versus immediate payment is crucial for informed decision-making, whether in personal finance or when engaging with services like assignment writing.

The Benefits Of BookMyEssay's Deferred Payment Assignment Assistance

Experience the power of quality assignment help with BookMyEssay's Deferred Payment Assignment Assistance. This unique service offers unparalleled benefits, revolutionizing the way students approach academic tasks. With BookMyEssay, you gain access to expert assistance without immediate financial strain, as the deferred payment option allows you to prioritize your education over upfront costs.

The flexibility of deferred payment empowers students to choose quality without compromise. BookMyEssay's team of skilled professionals ensures that your assignments meet the highest standards, providing in-depth research and well-crafted content. This approach not only enhances your academic performance but also fosters a deeper understanding of the subject matter.

By opting for BookMyEssay's deferred payment assignment assistance, you can manage your budget effectively while enjoying the confidence that comes with submitting top-notch assignments. Break free from financial constraints and unlock the full potential of your academic journey with the power of quality assignment help from BookMyEssay.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029