Real Interest Rate Formula

In the realm of finance and economics, understanding the real interest rate formula is crucial for making informed decisions. Real interest rate, a vital concept, is calculated by subtracting the inflation rate from the nominal interest rate. This formula, often used in financial analysis and investment planning, enables individuals and businesses to assess the true return on their investments after accounting for inflationary effects. Students encountering this formula in their mathematics assignments often seek guidance through "Mathematics Assignment Help" services to grasp its complexities and applications effectively.

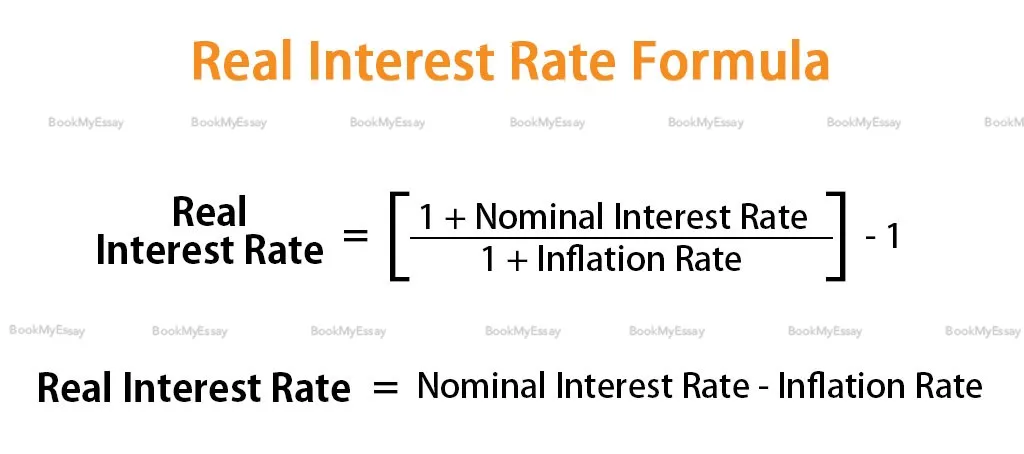

Real Interest Rate Formula: Real Interest Rate = Nominal Interest Rate - Inflation Rate

Through Mathematics Assignment Help, students can delve deeper into the intricacies of this formula, learning how changes in inflation rates impact investment decisions and economic policies. Mastering this formula empowers individuals to navigate financial landscapes with precision, ensuring sound investment strategies and informed economic analyses.

What Is The Formula For Calculating Real Interest Rates?

The formula for calculating real interest rates involves subtracting the inflation rate from the nominal interest rate. Real interest rate = Nominal interest rate - Inflation rate. This adjustment reflects the actual purchasing power gained or lost on an investment after accounting for inflation. To calculate effective interest rate, one must consider compounding periods and any additional fees or charges. The formula for calculating effective interest rate (also known as annual percentage yield or APY) is: Effective interest rate = (1 + Nominal interest rate / n) ^ n - 1, where 'n' represents the number of compounding periods per year. This formula provides a more accurate representation of the true return on investment, accounting for both nominal interest and the frequency of compounding. Understanding these formulas enables investors to make informed decisions about their investments, ensuring they accurately assess the actual returns adjusted for inflation and compounding effects.

How Do You Determine Real Interest Rates Using Mathematical Expressions?

Determining real interest rates involves accounting for inflation to assess the true cost of borrowing or investing. Mathematically, it's represented as: Real Interest Rate = Nominal Interest Rate - Inflation Rate. "Assignment Writing Help Tutors" can elucidate this equation by breaking down each component. They can define the nominal interest rate, which is the stated rate on a loan or investment, and the inflation rate, which measures the percentage change in prices over time. Tutors can guide students in obtaining accurate inflation data from reliable sources like government indices. Through step-by-step explanations, they clarify the subtraction process, emphasizing the significance of considering inflation's impact on purchasing power. Additionally, tutors can illustrate practical applications, showing how fluctuations in real interest rates influence consumer behavior, investment decisions, and economic policies. By demystifying the mathematical expressions, "Assignment Writing Help Tutors" empower students to comprehend and analyze real interest rates effectively.

Can You Articulate The Real Interest Rate Formula Succinctly?

To articulate the real interest rate formula succinctly, first, grasp the concept of nominal interest rate, representing the stated rate of interest without adjustments. Then, factor in inflation rate, the rate at which the general level of prices for goods and services rises. The real interest rate formula is simple: Real Interest Rate = Nominal Interest Rate - Inflation Rate. Understanding this formula is crucial in financial analysis, as it reveals the true purchasing power of investments or loans. Now, relating this to "How to Study Math Algebra Using Smart Tricks," employ mnemonic devices or visual aids to memorize the formula effortlessly. Practice by plugging in values to solve real-world problems. Utilize online resources or seek guidance from tutors to strengthen comprehension. With smart tricks and consistent practice, mastering algebraic concepts like real interest rate becomes more manageable and enjoyable.

What Variables Are Involved In The Real Interest Rate Formula?

In the realm of economics and finance, the real interest rate formula encompasses several crucial variables. When seeking "Assignment Help in UK" to dissect this formula, students should focus on key components. Firstly, the nominal interest rate plays a pivotal role, representing the rate quoted by lenders or investors. Secondly, inflation exerts significant influence, as it reflects the decrease in purchasing power over time. Subtracting the inflation rate from the nominal interest rate yields the real interest rate, which indicates the actual return on investment after adjusting for inflation. Additionally, the expected inflation rate can impact the real interest rate, influencing investment decisions and economic dynamics. Understanding these variables aids in comprehending the nuanced interplay between monetary policy, inflationary pressures, and the true cost of borrowing or investing, crucial concepts for students seeking comprehensive "Assignment Help in UK" in economics and finance.

How Does BookMyEssay Calculate Real Interest Rates Accurately?

BookMyEssay utilizes a sophisticated method to accurately calculate real interest rates, ensuring precision in financial assessments. Firstly, it considers the nominal interest rate, which represents the stated rate on a loan or investment. Then, it factors in inflation rates, crucial for determining the actual purchasing power of money over time. By subtracting the inflation rate from the nominal interest rate, BookMyEssay derives the real interest rate. This process accounts for changes in the general price level, providing a more realistic perspective on returns or costs associated with borrowing or lending. Additionally, BookMyEssay continually updates its data to reflect current economic conditions, ensuring accuracy in its calculations. Through this meticulous approach, BookMyEssay empowers users with reliable information for making informed financial decisions, whether in investments, loans, or savings.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029