Perpetuity Calculator

A Perpetuity Calculator is a powerful financial tool designed to simplify the calculation of perpetuity, a financial concept involving a series of cash flows that continue indefinitely. This calculator is particularly useful in finance and investment scenarios, helping individuals and businesses make informed decisions about long-term investments or annuities.

The Perpetuity Calculator takes into account key variables such as the annual cash flow and the discount rate, providing users with accurate results for present value calculations or future value projections. This tool proves invaluable in estimating the intrinsic value of perpetuities, aiding investors in assessing the potential returns of perpetual income streams.

With just a few inputs, users can swiftly determine the present value, future value, or annual cash flow of perpetuities, streamlining complex financial analyses. The ease of use and efficiency of a Perpetuity Calculator make it an essential resource for financial professionals, investors, and anyone involved in the calculation of perpetuity for strategic financial planning.

How Does A Perpetuity Calculator Determine Perpetual Cash Flows?

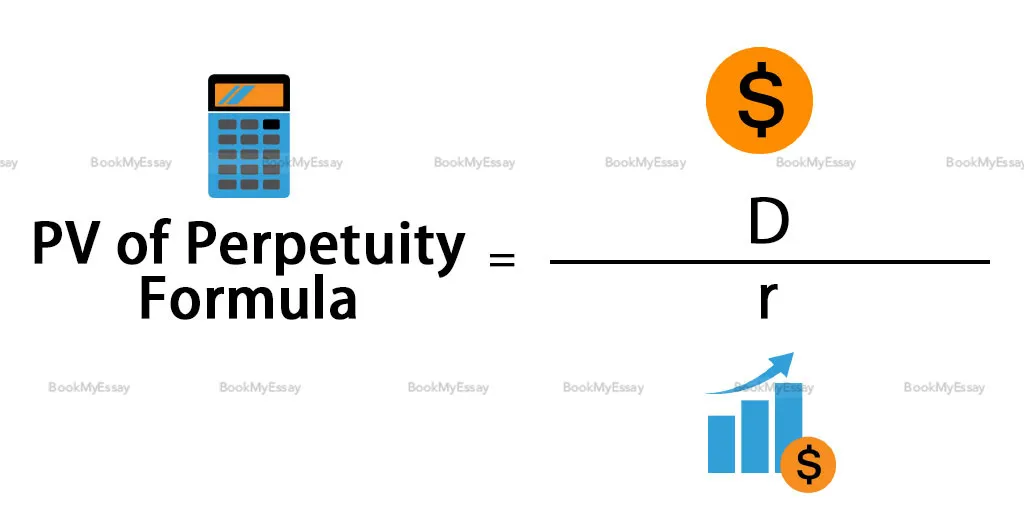

A perpetuity calculator is a valuable tool used in finance to determine perpetual cash flows, offering insights into the long-term financial health of an investment. It utilizes mathematical formulas to calculate the present value of an infinite series of cash flows that continue indefinitely. Key factors such as interest rate, growth rate, and initial cash flow are considered in these calculations.

Mathcad, a powerful mathematical software, can be instrumental in developing and utilizing perpetuity calculators. Mathcad Assignment Help and Math Assignment Help services are often sought after to navigate the complexities of these calculations. The perpetuity formula involves dividing the cash flow by the discount rate, providing a straightforward method to assess the present value of future cash flows in perpetuity.

Understanding perpetuity calculations is crucial for investors, financial analysts, and business professionals. The accuracy of these calculations can significantly impact investment decisions and financial planning, making perpetuity calculators an indispensable tool in the world of finance. Whether it's determining the value of a perpetuity or analyzing its impact on overall financial strategy, the perpetuity calculator serves as a reliable mathematical guide for perpetual cash flow assessments.

What Variables Are Essential For A Perpetuity Calculator To Function?

A perpetuity calculator is a useful tool in finance to determine the present value of a series of equal cash flows that continue indefinitely. To function accurately, certain variables are essential for the perpetuity calculator. Firstly, the interest rate or discount rate is crucial, representing the rate of return expected from an investment. This is often a key component in financial decisions and can significantly impact the present value of perpetuities.

The cash flow per period is another vital variable, representing the amount of money received or paid regularly. Additionally, the perpetuity calculator requires a consideration of the compounding frequency, as interest can compound annually, semi-annually, quarterly, or monthly.

A comprehensive perpetuity calculator may also include options for adjusting the perpetuity for inflation or tax considerations, providing a more realistic representation of future cash flows. Lastly, a user-friendly interface and robust math equation solver capabilities can enhance the functionality, making it accessible for users at various levels, from basic financial planning to advanced math coursework.

Can A Perpetuity Calculator Handle Variable Interest Rates Over Time?

A perpetuity calculator is a useful tool in finance to determine the present value of a perpetual stream of cash flows. However, its applicability to variable interest rates over time raises a crucial question. Variable interest rates can significantly impact the present value of future cash flows, making it essential to consider the dynamic nature of interest rates in financial calculations.

The challenge lies in the fact that traditional perpetuity calculators assume a constant interest rate. When faced with variable rates, a more sophisticated approach is required. Assignment Help Online platforms often cover such topics in academic writing, emphasizing the need for advanced financial models that can accommodate changing interest rates.

To address this issue, financial analysts may resort to using discounted cash flow (DCF) models or more advanced perpetuity calculators that allow for the incorporation of variable interest rates. These methods enable a more accurate representation of the present value, ensuring a more realistic assessment of financial scenarios in dynamic economic environments. As the financial landscape evolves, understanding and adapting to variable interest rates become crucial skills for students and professionals engaged in financial modeling and analysis.

How Do Students Benefit From BookMyEssay’s Writing Services?

Students can greatly benefit from BookMyEssay's writing services, especially due to the five features of skilled assignment writers they offer. Firstly, these writers possess extensive subject knowledge, ensuring that assignments are not only well-written but also deeply informed. Secondly, their proficiency in academic writing styles and formats guarantees that students' work adheres to the highest standards.

Thirdly, BookMyEssay's skilled writers are adept at conducting thorough research, ensuring that assignments are not only accurate but also backed by credible sources. This helps students to develop a deeper understanding of their subjects. Fourthly, the writers ensure timely delivery, allowing students to meet their deadlines and avoid unnecessary stress.

Lastly, the personalized approach of BookMyEssay's writers ensures that each assignment is tailored to the specific needs and requirements of the student. This not only results in high-quality work but also helps students gain a better grasp of the material. Overall, these five features make BookMyEssay writing services invaluable for students seeking academic success and a deeper understanding of their coursework.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029