Money Multiplier Calculator

A Money Multiplier Calculator is a vital tool in understanding the dynamics of money creation within an economy. It helps analyze how changes in interest rates affect the overall money supply. Interest Rates, Money and Central Banking Assignment Help context, this tool becomes indispensable for students and professionals alike.

By inputting variables like the reserve ratio and initial deposit, the Money Multiplier Calculator computes the potential expansion of the money supply through the banking system. It demonstrates the multiplier effect, where an initial injection of money leads to a larger increase in the overall money stock due to banks' ability to lend out a portion of deposits.

Understanding the Money Multiplier Calculator enables one to grasp the intricacies of monetary policy and its impact on economic stability. It empowers individuals to make informed decisions regarding financial planning, investment strategies, and policy analysis, making it an invaluable resource in the realm of finance and economics.

What's The Formula For The Money Multiplier In Banking Economics?

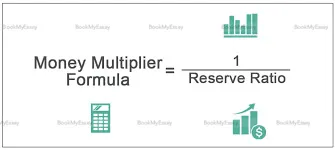

The money multiplier is a crucial concept in banking economics, representing the ratio of the change in the money supply to the change in the monetary base. It's derived from the process of banks creating money through fractional reserve banking.

What is a function of money? Money serves several functions in an economy, including medium of exchange, store of value, unit of account, and standard of deferred payment. The money multiplier formula, often denoted as MM, is calculated as 1 / reserve ratio. Here, the reserve ratio signifies the proportion of deposits that banks must keep in reserve as mandated by regulators.

The money multiplier plays a significant role in understanding the expansion of the money supply. When banks receive deposits, they can lend out a portion while keeping the required reserves. This lending process repeats, effectively multiplying the initial deposit and contributing to a larger money supply within the economy. Understanding this formula is essential for policymakers and economists to analyze and manage monetary policy effectively.

How Does The Reserve Ratio Affect The Money Multiplier Calculation?

Understanding the reserve ratio's impact on the money multiplier calculation is crucial for grasping monetary policy's nuances. In the realm of academic assignments and seeking assignment help online, this topic holds particular relevance.

The reserve ratio, set by central banks, determines the portion of deposits banks must hold as reserves. A lower reserve ratio means banks can lend out more money, increasing the money supply and amplifying the money multiplier effect. Conversely, a higher reserve ratio restricts lending, decreasing the money supply and reducing the multiplier effect.

For students delving into economic concepts, analyzing how changes in the reserve ratio influence the money multiplier offers insights into monetary policy's real-world applications. It showcases the intricate interplay between policy decisions and economic outcomes, making it a cornerstone of academic assignments in finance and economics.

With the complexity of these concepts, students often seek academic assignment help online to deepen their understanding and excel in their coursework. Mastering the dynamics of the reserve ratio and the money multiplier is essential for navigating the intricacies of monetary policy and financial systems.

Can A Higher Money Multiplier Indicate A More Efficient Banking System?

A higher money multiplier can indeed suggest a more efficient banking system. The money multiplier represents the extent to which a banking system can create money through the process of fractional reserve banking. In a more efficient system, banks can effectively leverage their reserves to create more loans and deposits, leading to a higher money multiplier.

This efficiency can have several positive implications. Firstly, it indicates that banks are effectively utilizing their resources to stimulate economic activity through increased lending. This can lead to higher investment levels, job creation, and overall economic growth.

From an Assignment Provider or Assignment Assistance perspective, a higher money multiplier in a country's banking system can translate to better opportunities for businesses to access credit and finance their operations. This can be particularly beneficial for startups and small businesses that rely on external funding to expand and thrive. Overall, a higher money multiplier reflects a robust and dynamic financial ecosystem that supports economic development.

BookMyEssay Uses A Wide Range Of Services To Provide Academic Support

BookMyEssay harnesses the power of quality assignment help through a comprehensive array of services, ensuring students receive top-notch academic support. Their commitment to excellence is evident in their approach, which encompasses various disciplines and levels of education. From essay writing to dissertation assistance, they cover a wide range of subjects with expertise and precision.

One of the key strengths of BookMyEssay is their team of experienced writers, each equipped with specialized knowledge in their respective fields. This ensures that every assignment is crafted with accuracy and depth, meeting the unique requirements of each student. Moreover, their commitment to timely delivery and adherence to academic standards further solidify their reputation as a reliable academic support provider.

Whether it's research papers, case studies, or programming assignments, BookMyEssay delivers quality assistance that empowers students to excel in their academic endeavors. The combination of expertise, reliability, and dedication makes BookMyEssay a trusted partner for students seeking comprehensive academic support.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029