Formula For Effective Annual Rate

The formula for effective annual rate (EAR) is pivotal in understanding the actual interest earned or paid on a financial product annually, considering compounding effects. Calculating the effective interest rate is crucial for comparing various financial options, especially when they compound interest at different frequencies.

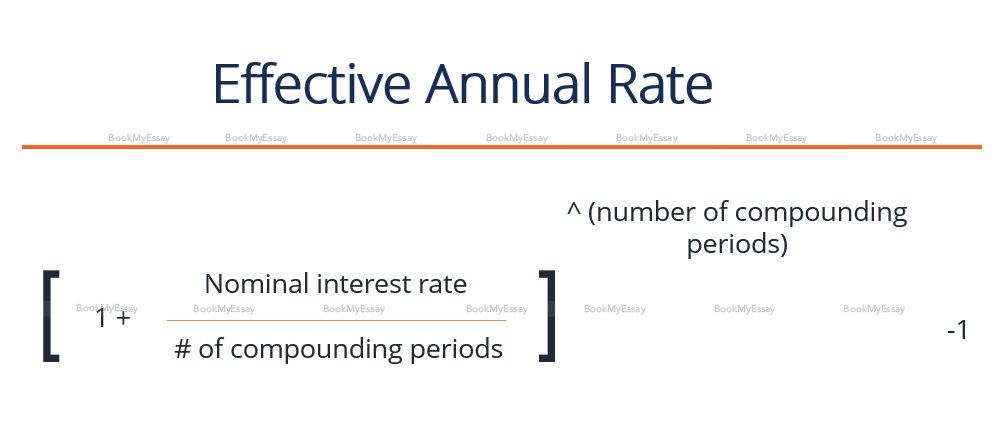

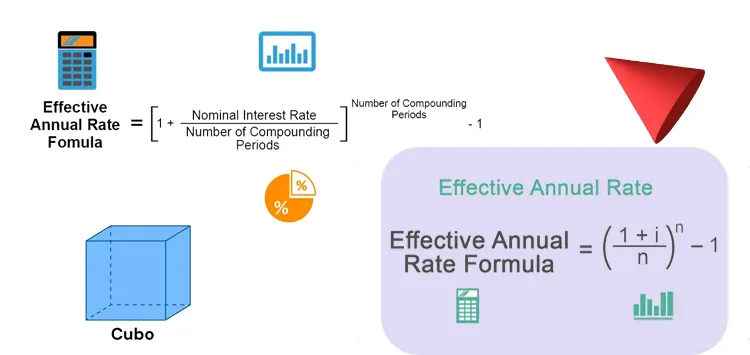

The formula for effective annual rate accounts for compounding periods within a year, expressed as:

EAR=(1+nr​)n−1

Here, r denotes the nominal interest rate, and n signifies the number of compounding periods per year. The formula showcases how frequently interest compounds, directly impacting the actual annual rate gained or paid on an investment or loan.

For instance, if a loan advertises a 6% nominal rate compounded semi-annually, the effective annual rate would differ from the nominal rate due to compounding effects. Plugging the values into the formula helps arrive at an accurate EAR, which is crucial for precise financial planning.

Understanding this formula empowers individuals and businesses to make informed decisions regarding loans, investments, or savings accounts by accurately assessing the true annual impact of interest accrual. This knowledge aids in maximizing returns and minimizing costs in financial endeavors.

What Does The Annual Rate Mean?

Understanding annual rates is pivotal in comprehending the dynamics of interest rates, money, and central banking assignment help. The annual rate refers to the interest percentage charged or earned on an investment or loan over a year. It is a crucial metric used in various financial calculations.

When examining interest rates in the context of loans or investments, the annual rate provides a standardized measure for comparison. It represents the cost of borrowing or the return on investment over a year, allowing individuals, businesses, and policymakers to assess the viability of financial decisions.

For instance, in banking assignments, understanding the annual rate aids in calculating the effective interest rate using formulas that consider compounding periods and nominal rates. This calculation yields the actual cost of borrowing or the true return on an investment over a year, known as the effective annual rate (EAR).

Furthermore, central banking assignment help often involve analyzing and setting interest rates that impact an economy's monetary policy. The annual rate is a critical indicator influencing borrowing, spending, investment, and inflation levels, thereby playing a pivotal role in shaping economic conditions.

Comprehending the annual rate is fundamental in navigating the intricate realms of interest rates, money management, and policymaking, making it a cornerstone in the field of finance and central banking assignment help.

The Economy's Reaction To Annual Rate Changes?

Custom assignment writing services often cover topics related to Finance Assignment Help, delving into how changes in annual rates impact the economy. When interest rates fluctuate, their effects ripple through various sectors. Lower rates tend to stimulate borrowing, encouraging spending and investment. Individuals may be inclined to take out loans for homes, cars, or businesses, boosting economic activity.

Conversely, higher annual rates might deter borrowing, causing a slowdown in spending and investment. This can lead to decreased consumer spending, reduced business expansion, and a potential decline in economic growth. Companies might postpone expansion plans due to higher borrowing costs, affecting job creation and overall economic stability.

Assignment Help Online often explores these economic reactions, emphasizing the intricate relationship between interest rates and economic indicators. Central banks play a pivotal role in regulating rates to manage inflation, employment, and economic growth. Their decisions affect borrowing costs, impacting the behavior of consumers, businesses, and financial markets.

Understanding the dynamic responses of the economy to annual rate changes is crucial in Finance Assignment Help, allowing students to grasp how policy decisions influence financial markets and the broader economy.

What Is The Effective Annual Rate Formula Used By BookMyEssay?

BookMyEssay employs the Effective Annual Rate (EAR) formula as a fundamental component within economics essays on bank marketing. This formula integrates six pivotal elements essential for comprehending the intricacies of interest rates. The six key components in an economics essay on bank marketing encompass nominal interest rate, compounding periods, inflation rate, fees, discounts, and time frames.

The EAR formula, a vital tool in finance, is calculated as follows: EAR = (1 + r/n)^n - 1, where 'r' denotes the nominal interest rate and 'n' represents the number of compounding periods within a year. By incorporating these variables, the formula accommodates varying compounding frequencies and accurately computes the actual annual interest rate applicable to a financial product or investment.

BookMyEssay homework help elucidate how this formula enables a comprehensive analysis of interest rates, considering inflation, compounding intervals, and additional costs or discounts associated with banking services. Understanding these elements allows students to evaluate the true cost of borrowing or the actual return on investments in the banking sector, thereby enhancing their comprehension of bank marketing strategies and financial decision-making processes.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029