Fishers Equation

Fishers Equation, a fundamental concept in economics, plays a pivotal role in understanding the relationship between nominal interest rates, real interest rates, and inflation. It can also be used to illustrate the concept of Assignment Writing Assistance, where students seek help with their academic tasks.

In Fisher's Equation, the nominal interest rate (i) is equal to the sum of the real interest rate (r) and the expected inflation rate (π). Mathematically, it's represented as i = r + π. This equation highlights the impact of inflation on the purchasing power of money and how it affects the returns on investments.

When students face challenging assignments related to Fisher's Equation or any other economic concept, they often turn to Assignment Writing Assistance services for guidance. These services provide expert writers who can explain complex economic theories, offer analysis, and assist in crafting well-researched papers. It ensures that students not only grasp economic principles but also excel in their academic endeavors. Just as Fisher's Equation simplifies the relationship between interest rates and inflation, Assignment Writing Assistance simplifies the path to academic success.

Examining Fisher Equation Fundamental Elements

When it comes to understanding the fundamental elements of the Fisher Equation, the field of economics often intersects with mathematics, making it a prime candidate for mathematics assignment help. The Fisher Equation is a key component of economic theory, connecting nominal and real interest rates with inflation expectations.

In a mathematics assignment related to the Fisher Equation, students might explore the mathematical relationships underlying the equation. They would delve into the intricacies of interest rates, inflation, and their impact on real returns. This involves working with mathematical concepts such as percentages, equations, and graphs to model economic phenomena.

Furthermore, examining the Fisher Equation can help students develop critical thinking and problem-solving skills. They must consider how economic variables interact and how changes in inflation rates affect interest rates and vice versa.

In conclusion, the Fisher Equation serves as a fascinating subject for mathematics assignment help, as it requires a deep understanding of both economic principles and mathematical concepts, making it a valuable topic for students aiming to expand their knowledge and analytical skills in economics and mathematics.

Describe the Fisher Equation

The Fisher Equation is a fundamental concept in economics that relates nominal and real interest rates to the inflation rate. It is a crucial tool in understanding the relationship between interest rates and purchasing power. In the context of "Assignment Help Free From Plagiarism," it is essential to ensure that academic work is original and properly cited to avoid plagiarism.

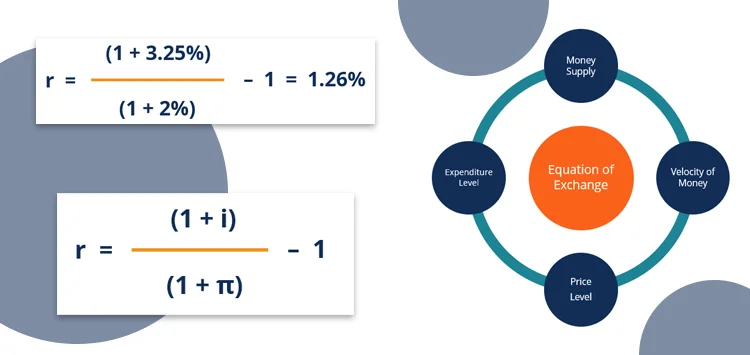

The Fisher Equation is expressed as:

Nominal Interest Rate = Real Interest Rate + Inflation Rate

This equation highlights that the nominal interest rate (the rate actually paid or earned on an investment) is equal to the sum of the real interest rate (the rate adjusted for inflation) and the inflation rate. It demonstrates that in an environment of rising inflation, the nominal interest rate must increase to maintain the same real interest rate. Conversely, in periods of deflation, the nominal interest rate can be lower than the real interest rate.

When providing assignment help, it's crucial to explain the Fisher Equation while emphasizing the importance of properly citing sources to maintain academic integrity and prevent plagiarism.

How Is The Fisher Effect Calculated?

The Fisher Effect is a concept in economics that helps calculate the nominal interest rate, taking into account inflation and the real interest rate. While it may sound complex, there are simple ways to understand and calculate it. This understanding can be analogous to finding Simple Ways to Make the Math Homework Easy and Simple.

To calculate the Fisher Effect, you can use the formula:

Nominal Interest Rate (i) = Real Interest Rate (r) + Inflation Rate (π)

Just like breaking down a complicated math problem into manageable steps, this equation separates the nominal interest rate into its two components. The real interest rate represents the return on an investment adjusted for inflation, and the inflation rate accounts for the change in the general price level.

This calculation helps investors and economists gauge the true return on an investment in a world of changing prices. By simplifying it, one can better comprehend the relationship between nominal interest rates, real interest rates, and inflation, much like simplifying math problems makes homework easier to tackle.

How Does Fisher's Equation Relate to Nominal and Real Interest Rates?

Fisher's equation plays a crucial role in understanding the relationship between nominal and real interest rates, and it is a valuable concept when seeking help with assignment online. This economic principle establishes a fundamental connection between these two key interest rate metrics.

The equation states that the nominal interest rate (i) is equal to the sum of the real interest rate (r) and the expected inflation rate (π). In mathematical terms, i = r + π. This formula is instrumental in the realm of finance, as it illustrates how changes in nominal rates are influenced by changes in either real rates or expected inflation.

When seeking assistance with assignments online, understanding Fisher's equation is vital. It allows students to analyze the impact of economic conditions on interest rates. An increase in inflation expectations can drive up nominal rates, while a rise in real interest rates can have the same effect. By grasping this concept, students can better evaluate financial decisions, economic policies, and investment strategies, making Fisher's equation a valuable topic to explore with the help of online resources.

What Role Does BookMyEssay Attribute to Fisher's Equation in Monetary Theory?

BookMyEssay recognizes the significance of Fisher's Equation in monetary theory as a fundamental concept in the realm of economics. Irving Fisher, an American economist, introduced this equation, which states that the nominal interest rate is equal to the real interest rate plus the expected inflation rate. This equation plays a pivotal role in understanding the relationship between interest rates, inflation, and monetary policy.

Fisher's Equation is a crucial tool for economists and policymakers. It helps in making informed decisions regarding interest rates and inflation management. When inflation is high, central banks may increase nominal interest rates to maintain real interest rates and curb inflation. Conversely, in a deflationary environment, central banks may lower nominal rates to stimulate economic activity.

BookMyEssay acknowledges that comprehending Fisher's Equation is indispensable for students, professionals, and policymakers in the field of economics and finance. It forms the foundation for discussions on monetary policy, inflation targeting, and interest rate adjustments, making it an essential aspect of modern monetary theory.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029