Fisher Equation

The Fisher Equation is a fundamental concept in finance and economics, often discussed in the context of financial accounting assignments. It relates nominal and real interest rates, providing critical insight into the effects of inflation on financial markets. The equation, named after economist Irving Fisher, states that the nominal interest rate (i) is equal to the sum of the real interest rate (r) and the expected inflation rate (π). Mathematically, it is represented as i = r + π.

For students seeking financial accounting assignment help, understanding the Fisher Equation is crucial. It highlights the importance of adjusting nominal interest rates for inflation to determine their true purchasing power. This knowledge is essential when analyzing financial data, particularly when assessing investment opportunities, bond yields, and interest rate policies. It allows accountants and financial professionals to make more accurate assessments and informed decisions in a constantly changing economic environment, making it a cornerstone of financial

How Does The Fisher Equation Work?

The Fisher Equation is a fundamental concept in economics that relates nominal and real interest rates with inflation. It serves as a cornerstone for understanding the relationship between money supply, inflation, and interest rates. The formula is expressed as:

1+Nominal Interest Rate=(1+Real Interest Rate)×(1+Inflation Rate)

This equation essentially states that the nominal interest rate is the sum of the real interest rate and the inflation rate. It provides valuable insights into how changes in monetary policy affect the economy. For instance, an increase in the money supply may lead to higher inflation, which, according to the Fisher Equation, would result in an increase in nominal interest rates. Conversely, a decrease in the money supply could lead to lower inflation and consequently lower nominal interest rates.

Students often seek "Formula Solver Assignment Help" to understand and apply this equation in various economic scenarios. By utilizing this assistance, they can grasp the intricate relationship between nominal and real interest rates, and inflation, which is vital in making informed economic decisions.

What Is The Fisher Effect Calculation Process?

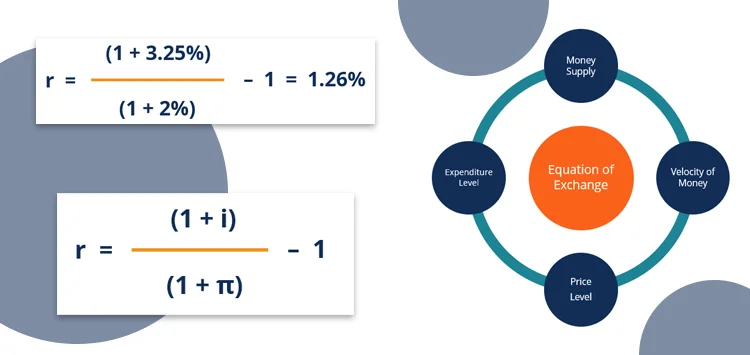

The Fisher Effect is a crucial concept in economics, often tackled in Mathematics assignments. It establishes a relationship between nominal interest rates, real interest rates, and inflation. The Fisher Effect equation is:

1+i=(1+r)×(1+π)

Where:

- represents the nominal interest rate.

- signifies the real interest rate.

- denotes the inflation rate.

In the Fisher Effect calculation process, one can determine any of these variables given the other two. For instance, if nominal and real interest rates are known, you can find the expected inflation rate:

π=(1+i)/(1+r)−1

Alternatively, if you have the nominal interest rate and the expected inflation rate, you can solve for the real interest rate:

r=(1+i)/(1+π)−1

This equation allows economists and financial analysts to make informed predictions and decisions based on interest rate movements and inflation forecasts. Understanding the Fisher Effect and its mathematical underpinnings is essential for effectively managing economic policies and investments. For further insights and Mathematics Assignment Help, consult reputable academic resources and experts in the field.

Fisher Equation Formula: Understanding Quantity Theory of Money Excellent

The Fisher Equation Formula is a fundamental concept in understanding the Quantity Theory of Money, and it is essential for mathematics brilliant candidates to grasp its significance. When it comes to math assignment help, exploring and comprehending the Fisher Equation Formula can be extremely beneficial.

For the best options to excel in mathematics, brilliant candidates should delve into this topic. The Fisher Equation Formula states that the nominal interest rate is equal to the sum of the real interest rate and the expected inflation rate. It can be expressed as i = r + π, where i represents the nominal interest rate, r represents the real interest rate, and π represents the expected inflation rate.

Mastering this formula enables brilliant candidates to analyze the relationship between interest rates and inflation, strengthening their understanding of monetary economics. Furthermore, when seeking math assignment help, having a solid grasp of the Fisher Equation Formula will allow candidates to solve complex mathematical problems related to interest rates and inflation.

The Fisher Equation Formula is an excellent tool for mathematics brilliant candidates, providing them with a deeper understanding of the Quantity Theory of Money. It is a topic that should be explored by those seeking the best options for mathematics Brilliant Candidates.

Services For Students in the US, UK, and Australia

BookMyEssay provides exceptional services for students in the US, UK, and Australia, including essay writer for Australian students. With a team of qualified and experienced writers, BookMyEssay offers top-notch academic assistance tailored to meet the specific needs of students from these regions.

Whether students require help with essays, assignments, or dissertations, BookMyEssay is the go-to platform. For Australian students, the dedicated essay writer service offered by BookMyEssay ensures high-quality and well-researched papers that adhere to Australian academic standards.

Their expert writers possess comprehensive knowledge and understanding of the Australian education system, making them capable of delivering exceptional work. BookMyEssay takes pride in its commitment to providing students with exemplary services. They understand the unique requirements of students in the US, UK, and Australia and offer tailored solutions to meet their academic needs effectively. With BookMyEssay, students from these regions can confidently seek assistance and achieve academic success.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029