Effective Annual Interest Rate

Effective Annual Interest Rate (EAIR) is a crucial concept in finance and plays a pivotal role in economic decision-making. When students encounter challenges understanding this topic, seeking "economics assignment help" becomes imperative. The EAIR reflects the true cost of borrowing or the actual return on investment, considering compounding over a specified time frame. This metric is essential for comparing different financial products and making informed financial decisions.

Proficient assistance with economics assignments can clarify the intricacies of calculating EAIR, incorporating factors like compounding frequency and nominal interest rates. Expert guidance ensures a comprehensive understanding of the economic implications and applications of EAIR, allowing students to excel in their studies. Accessing "economics assignment help" not only aids in solving numerical problems but also fosters a deeper comprehension of the economic principles underpinning effective annual interest rates. In the dynamic field of economics, mastering concepts like EAIR is indispensable for informed financial analysis and decision-making.

What Is The Effective Annual Interest Rate And How Does It Differ From The Nominal Rate?

The Effective Annual Rate (EAR), often referred to as the annual equivalent rate (AER), is a crucial financial metric representing the true cost of borrowing or the actual yield on an investment over a specified time period. Unlike the Nominal Interest Rate, which is the stated interest rate without accounting for compounding, the EAR considers compounding effects and provides a more accurate reflection of the overall cost or return.

To calculate the Effective Annual Rate, one must account for the frequency of compounding, which can significantly impact the final amount paid or earned. The formula for EAR incorporates compounding periods, enabling a more precise assessment of the interest or investment's true annualized cost or return. Financial institutions often use EAR to help consumers make informed decisions by presenting a more comprehensive picture of the actual financial impact. Understanding the distinction between Nominal and Effective Annual Rates is essential for making well-informed financial choices.

How Is The Effective Annual Interest Rate Calculated, And What Factors Does It Take Into Account?

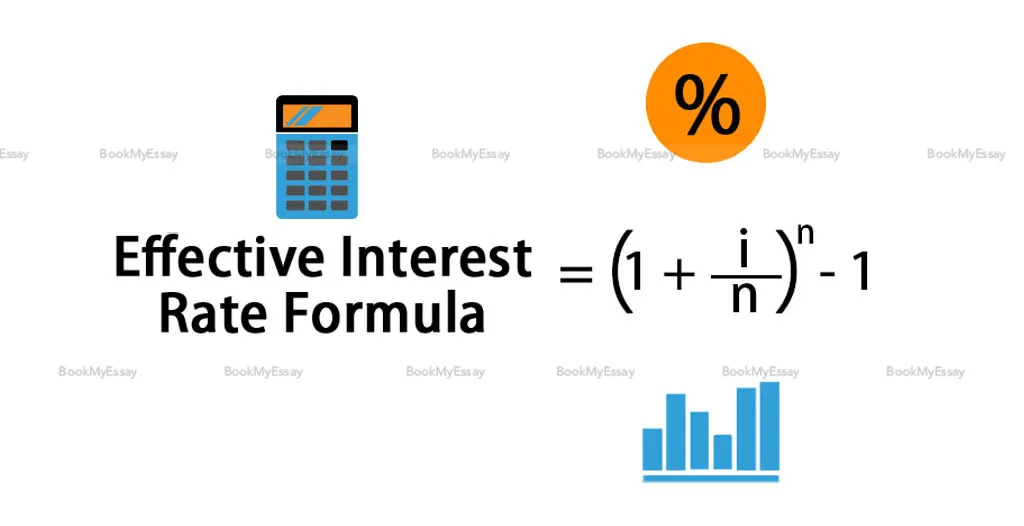

Effective Annual Interest Rate (EAR) is a crucial metric in financial analysis, providing a comprehensive view of the true cost of borrowing. Calculating EAR involves considering various factors beyond the nominal interest rate. To compute EAR accurately, one must account for compounding frequency, as compounding periods affect the overall interest accrued. The formula for EAR is:

EAR=(1+nr​)n−1

where r is the nominal interest rate and n is the number of compounding periods per year. This formula takes into account the compounding effect, offering a more realistic representation of the annual cost.

When dealing with financial products, such as loans or credit cards, understanding the EAR is essential to make informed decisions. It aids consumers in comparing different offers from various providers. For those seeking financial advice or assistance in navigating these complexities, all writing services can play a pivotal role by providing clear, concise explanations and guidance on calculating and interpreting Effective Annual Interest Rates.

Can You Explain The Significance Of The Effective Annual Interest Rate In Financial Decision-Making?

Compounded Annual Growth Rate Of Walmart In India

The Effective Annual Interest Rate (EAR) holds paramount significance in financial decision-making as it provides a comprehensive view of the true cost of borrowing or the actual return on investment. This rate accounts for compounding, reflecting the impact of compounding periods on the nominal interest rate. Similarly, the Compounded Annual Growth Rate (CAGR) is crucial for evaluating investment performance. Shifting focus to Walmart's presence in India, the CAGR of its operations is vital. It illustrates the smoothed annual growth rate over a specified period, aiding in understanding the sustained expansion or contraction of the retail giant in the Indian market. Examining the CAGR of Walmart in India informs strategic decisions, offering insights into the long-term growth trajectory. When coupled with the EAR in financial decision-making, these metrics empower businesses to make informed choices about investments, loans, and overall financial strategies, ensuring a holistic understanding of returns and costs over time.

Why Is It Important For Borrowers And Investors To Consider The Effective Annual Interest Rate?

Understanding the Effective Annual Interest Rate (EAR) is crucial for both borrowers and investors, making it a vital consideration in financial decisions. For borrowers, the EAR represents the true cost of borrowing, accounting for compounding over time. This metric provides a comprehensive view of the loan's actual annual cost, allowing borrowers to make informed decisions about different loan options. On the investor side, calculating the EAR is essential for evaluating the actual return on investment, especially when comparing various opportunities with different compounding frequencies. Savvy investors recognize that the EAR offers a more accurate measure than nominal interest rates, enabling them to make more precise financial projections. Therefore, for the best assignment helper in financial decision-making, borrowers and investors alike should factor in the Effective Annual Interest Rate to ensure accurate assessments of costs and returns, leading to more informed and advantageous choices in the dynamic landscape of finance.

How Does BookMyEssay Calculate The Effective Annual Interest Rate To Ensure Accurate Financial Assessments?

BookMyEssay employs a meticulous approach to calculate the Effective Annual Interest Rate (EAR), ensuring precision in financial assessments. The process involves considering compounding periods, a critical factor often overlooked. The EAR accounts for compounding frequency, reflecting the true cost of borrowing or the actual return on investment.

BookMyEssay starts by gathering basic loan or investment details, such as nominal interest rate and compounding frequency. Using a standardized formula that incorporates these parameters, the EAR is derived. By factoring in compounding, BookMyEssay prevents underestimation of costs or overestimation of returns, providing clients with a more accurate financial outlook.

This calculation method is crucial for clients making informed decisions about loans or investments, as it captures the impact of compounding on the overall cost or return. BookMyEssay commitment to precise financial assessments through EAR calculation enhances its credibility as a reliable platform for individuals and businesses seeking accurate financial insights.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029