Definition Of Deferred

Deferred refers to the postponement or delay of a particular action or obligation. In the realm of financial transactions, the term is often associated with the "standard of deferred payment tools." These tools encompass various financial instruments that allow individuals or entities to delay the settlement of debts or payments to a future date. In the context of an essay, exploring the intricacies and significance of standard deferred payment tools provides insight into the functioning of financial systems. Such tools can include promissory notes, bonds, and other contractual arrangements that facilitate delayed payment, offering flexibility and liquidity in economic transactions. Understanding the dynamics of deferred payment tools is crucial in comprehending the nuances of financial markets and ensuring efficient resource allocation.

What Is The Definition Of Deferred In Financial Terms?

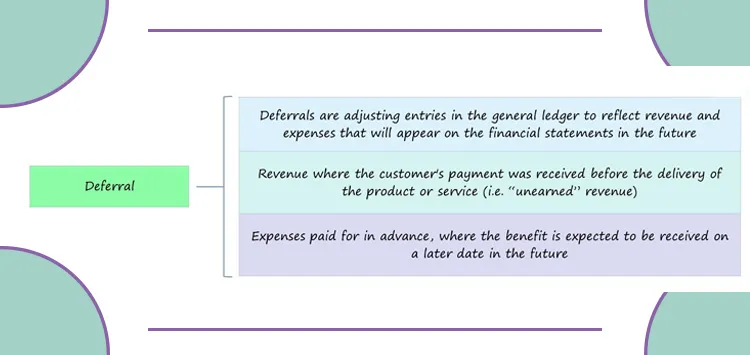

In financial terms, "deferred" refers to the postponement of a payment or financial obligation to a later date. When someone asks, "What does payment deferred mean?" they are inquiring about delaying the settlement of a debt or financial transaction. Deferred payments are common in various financial arrangements, such as loans, where borrowers may be granted a grace period before they start repaying the principal amount. This delay can provide individuals or businesses with the flexibility to manage cash flow or address temporary financial challenges. However, it's crucial to consider any associated interest or fees during the deferral period. Understanding the implications of deferred payments is essential for sound financial planning and responsible fiscal management.

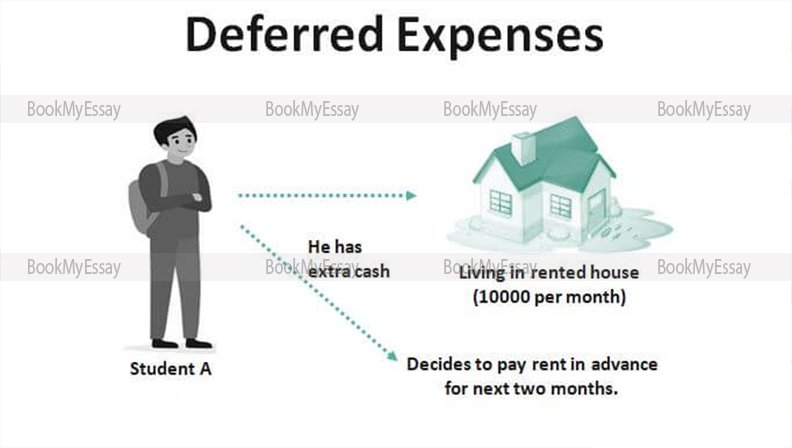

How Is Deferred Defined In Accounting Principles?

Deferred, in accounting principles, refers to the postponement of recognizing certain revenues or expenses until a later period. This accounting concept aligns with the accrual basis, ensuring that financial statements accurately reflect the economic reality of transactions. Deferred items include deferred revenue, where income is recognized after goods or services are delivered, and deferred expenses, delaying the recognition of costs. Online assignment writers play a crucial role in explaining these principles, aiding students in grasping the complexities of deferred accounting. They help bridge the gap between theoretical knowledge and practical application, ensuring a comprehensive understanding of how deferred entries impact financial reporting. As academic guides, online assignment writers facilitate learning and promote proficiency in accounting principles related to deferrals.

Can You Explain The Meaning Of Deferred In A Legal Context?

In a legal context, "deferred" refers to the postponement or delay of a legal obligation or action. When discussing legal writing, understanding the term is crucial for precise communication. In the realm of law, various documents, such as contracts or court proceedings, may involve deferred actions or decisions. The significance lies in the careful use of language to convey the postponement of rights, duties, or resolutions. For those aspiring to enhance their legal writing skills, mastering the nuances of terms like "deferred" is essential. Incorporating clarity and precision in legal documents, as outlined in "7 Ways to Improve Your Legal Writing Skills," ensures effective communication and strengthens the overall impact of legal arguments.

What Does Deferred Imply In The Context Of Taxes?

In the realm of taxes, the term "deferred" carries significant implications. When discussing taxes, deferral generally refers to the postponement of tax payments to a later date, allowing taxpayers to delay their financial obligations. This strategic delay often occurs through various mechanisms such as deferred tax liabilities or tax-deferred investment accounts. In essence, deferring taxes provides individuals and businesses with the flexibility to manage their cash flows more efficiently. Students seeking a comprehensive understanding of this concept can explore the intricacies of tax deferral through reputable assignment help online resources. These platforms offer valuable insights, ensuring a grasp of the complexities involved in navigating tax-related matters and facilitating academic success.

What Is The BookMyEssay Perspective On Deferred Assignment Definition?

BookMyEssay, a prominent academic writing service, provides a comprehensive perspective on the definition of deferred assignments. According to their approach, a deferred assignment refers to a task or project with a postponed deadline. BookMyEssay recognizes the challenges students face in managing their academic responsibilities and offers tailored assistance for deferred assignments. Their perspective emphasizes the importance of understanding the reasons behind deferrals, such as unforeseen circumstances or time constraints. By providing expert insights and solutions, BookMyEssay aims to empower students to navigate deferred assignments successfully. Their commitment to delivering high-quality content aligns with the evolving needs of students, ensuring a supportive approach to academic success in the face of deferred assignments.

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029

3 Bellbridge Dr, Hoppers Crossing, Melbourne VIC 3029